- Overview

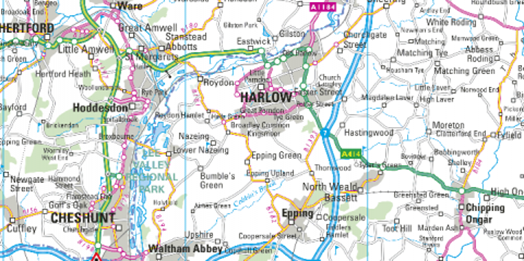

Harlow is a town and local government district in the west of Essex, England. It is a new town, situated on the border with Hertfordshire and London, Harlow occupies a large area of land on the south bank of the upper Stort Valley, which has been made navigable through other towns and features a canal section near its watermill.

The M11 motorway passes through the east of the district, entirely to the east of the town. Harlow has its own commercial and leisure economy. It is also an outer part of the London commuter belt and employment centre of the M11 corridor which includes Cambridge and London Stansted Airport to the north.

- Location & Transportation

Harlow has easy access to other towns and cities in the UK. It is served by two mainline stations and can reach London Liverpool Street in 45 minutes, London Stansted Airport in 17 minutes and Cambridge in 40 minutes. Harlow is within a 40-minute drive to Tottenham Hale, where he can take the Victoria Line to London’s West End.

Harlow Transport Map

- History

Old Harlow

Old Harlow is a village-size suburb founded by the early medieval age and most of its high street buildings are early Victorian and residential, mostly protected by one of the Conservation Areas in the district. In Old Harlow there is a field named Harlowbury, a de-settled monastic area which has the remains of a chapel.

The New Town

The original Harlow New Town was built after World War II to ease overcrowding in London and the surrounding areas due to the devastation caused by the bombing during the Blitz. It is one of the results of the New Towns Act of 1946, with the master plan for Harlow drawn up in 1947 by Sir Frederick Gibberd. The town was planned from the outset and was designed to respect the existing landscape. Each of the town’s neighbourhoods is self-supporting with its own shopping precincts, community facilities and pubs.

The town centre, and many of its neighbourhood shopping facilities have undergone major redevelopment, along with many of the town’s original buildings. Subsequently, many of the original town buildings, including most of its health centres, the Staple Tye shopping centre and many industrial units have been rebuilt. Gibberd’s original town hall, a landmark in the town, has been demolished and replaced by a new civic centre and The Water Gardens shopping area in the 1980s.

Redevelopment

Since becoming a new town, Harlow has undergone several stages of expansion, the first of which was the “mini expansion” that was created by the building of the Sumners and Katherines estates in the mid-to-late seventies to the west of the existing town. Since then Harlow has further expanded with the Church Langley estate completed in 2005, and its newest neighbourhood Newhall has completed the first stage of its development, with the second stage underway in 2013. The Harlow Gateway Scheme, also completed, first involved the relocation of the Harlow Football Stadium & the building of a new hotel, apartments and a restaurant adjacent to Harlow Town railway station. Phase 2 of this scheme involved the construction of 530 eco-homes on the former sports centre site and the building of the Harlow Leizurezone adjacent to the town’s college in the late 2000s/early 2010s.

Other major developments under consideration include both a northern and southern bypass of the town, and significant expansion to the north, following the completed expansion to the east.

The south of the town centre also underwent major regeneration, with the new Civic Centre being built and the town’s famous Water Gardens being redeveloped in the 1980s, a landscape listed by English Heritage.

In 2011 the government announced the creation of an enterprise zone in the town. Harlow Enterprise Zone consists of two separate sites under development, at Templefields and London Road, with the London Road site divided into north and south business parks.

- Amenities

Environment

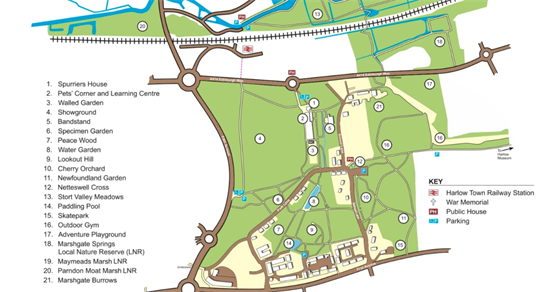

Harlow is located in the upper Stort Valley, on the border between Hertfordshire and London, offering the best of both worlds. A short walk from open green Spaces, including 164-acre Harlow Town Park, just 30 minutes by train from central London.

Map of Harlow Town Park

Restaurants, Shopping and Leisure

The city centre of Harlow is home to a number of shops and restaurants and is home to the Harlow Leisure Area and Harlow Playhouse.

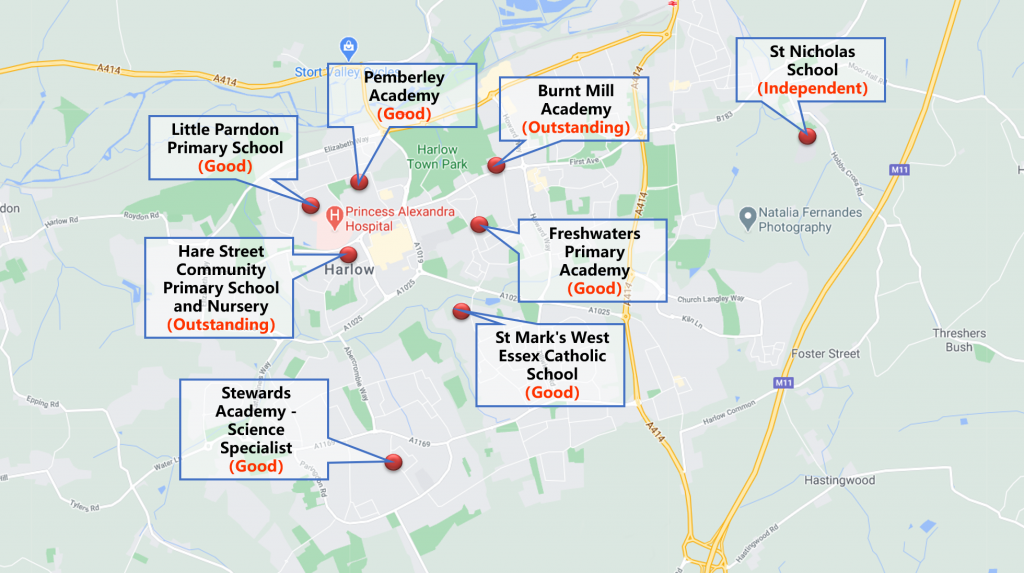

Schools

There are many famous primary and secondary schools in and around Harlow. According to Ofsted, the leading school raters in the UK, schools rated Outstanding or Good in Harlow and surrounding areas were:

Primary School

| School Name | Rating |

| Hare Street Community Primary School and Nursery | Outstanding |

| Pemberley Academy | Good |

| Little Parndon Primary School | Good |

| Freshwaters Primary Academy | Good |

Secondary School

| School Name | Rating |

| Burnt Mill Academy | Outstanding |

| St Mark’s West Essex Catholic School | Good |

| Stewards Academy – Science Specialist | Good |

There is also an independent school, St Nicholas School, in Harlow, which is not included in Ofsted Ratings.

- Famous Industry

Raytheon and GlaxoSmithKline both have large premises within Harlow. In July 2017 Public Health England had bought the vacant site from GSK (GlaxoSmithKline) hoping to move altogether 2,745 jobs there, of which about 500 are from Porton Down.

Nortel had a large site on the eastern edge of the town, acquired when STC was bought in 1991, and it was here that Charles K. Kao developed optical fibre data transmission. Nortel still has a presence, but it is much reduced. The site now is host to electronics, education and housing companies. One of Europe’s leading online golf stores, Onlinegolf, is based in Harlow.

- Big Developments nearby on Sale

Harlow Quarter – by Strawberry Star Homes

Strawberry Star Homes has launched an exciting new residential-led, mixed-use development in Harlow, a key Essex regeneration hotspot. Harlow Quarter is set to transform Harlow town centre with planning permission for 523 new apartments, set amongst beautifully landscaped public spaces and a retail avenue. Currently available is phase 1 of the scheme which will comprise of 163 new apartments. The development is estimated to be fully complete in 2022.

Price List of Harlow Quarter (by Strawberry Star Homes)

| Property Type | Area (sqft) | £/sqft | Value per Unit |

| 1 Bed Apartment | 497 | £469 | £233,000 |

| 2 Bed Apartment | 611 | £484 | £296,000 |

Gilden Park – by Barratt Homes

Gilden Park is a popular development located in Old Harlow. Following the success of phase one, Barratt Homes is now selling phase two which has a selection of 3- and 4-bedroom homes plus the last remaining one-bedroom apartment (sold out) available to purchase using Home Reach’s Part-Buy-Part-Rent scheme. This development has plenty of open space and parks on its doorstep, excellent commuter links, good and outstanding schools nearby.

Price List of Gilden Park (by Barratt Homes)

| Property Type | Area (sqft) | £/sqft | Value per Unit |

| 3 Bed Mid-terrace House | Not Provided | N/A | £378,000 |

| 3 End-terraced Bed House | Not Provided | N/A | £388,500 |

| 3 Bed Detached House | Not Provided | N/A | £420,000 |

| 4 Bed Detached House | Not Provided | N/A | £537,500 |

Gilden Park – by Taylor Wimpey

Another new development in Gilden Park is operated by Taylor Wimpey. Offering a range of stylish 1- and 2-bedroom apartments (sold out) alongside 2- and 3-bedroom houses, this development offers a brilliant range of starter homes with excellent links to London. Taylor Wimpey’s Gilden Park development is close to excellent schools and transport links, and the homes are designed with the needs of a range of buyers in mind, meaning there is something for everyone.

Price List of Gilden Park (by Taylor Wimpey)

| Property Type | Area (sqft) | £/sqft | Value per Unit |

| 2 Bed Coach House | 653 | £481 | £314,000 |

| 3 Bed Semi-detached House | 866 | £467 | £404,000 |

Gilden Park – by Persimmon

Part of Gilden Park is Persimmon’s collection of stylish modern homes which forms an extension to Old Harlow in Essex. Nestled in the Stort Valley to the west of the county, and on the Hertfordshire border, its location is highly sought-after.

The development operated by Persimmon has characteristics as follows: (1) Mix of 1- and 2- bedroom apartments (sold out) and 2, 3, 4 and 5 bedroom homes; (2) M11 and the M25 nearby; (3) 3 miles from Harlow town centre; (4) Within catchment of outstanding schools; (5) Beautiful countryside surroundings; (6) London Liverpool Street in under 40-minutes by train.

Price List of Gilden Park (by Persimmon)

| Property Type | Area (sqft) | £/sqft | Value per Unit |

| 2 Bed Mid-terrace House | Not Provided | N/A | £330,000 |

| 2 Bed Semi-detached House | Not Provided | N/A | £335,000 |

| 3 Bed Detached House | Not Provided | N/A | £410,000 |

| 4 Bed Semi-detached House | Not Provided | N/A | £440,000 |

| 4 Bed Semi-detached House | Not Provided | N/A | £450,000 |

| 4 Bed Detached House | Not Provided | N/A | £465,000 |

| 4 Bed Detached House | Not Provided | N/A | £475,000 |

Atelier – by Countryside & Home Group

Atelier is a Countryside development in partnership with Home Group. With a wide choice of house styles and accommodation, all benefitting from the superb Countryside design and specification, it’s a development suitable for first time buyers, couples and growing families alike.

Price List of Atelier (by Countryside & Home Group)

| Property Type | Area (sqft) | £/sqft | Value per Unit |

| 1 Bed Terraced House | 700 | £450 | £315,000 |

| 2 Bed Terraced House | 704 | £494 | £348,000 |

| 4 Bed Terraced House | 1129 | £376 | £425,000 |

| 4 Bed End-terraced House | 1129 | £376 | £425,000 |

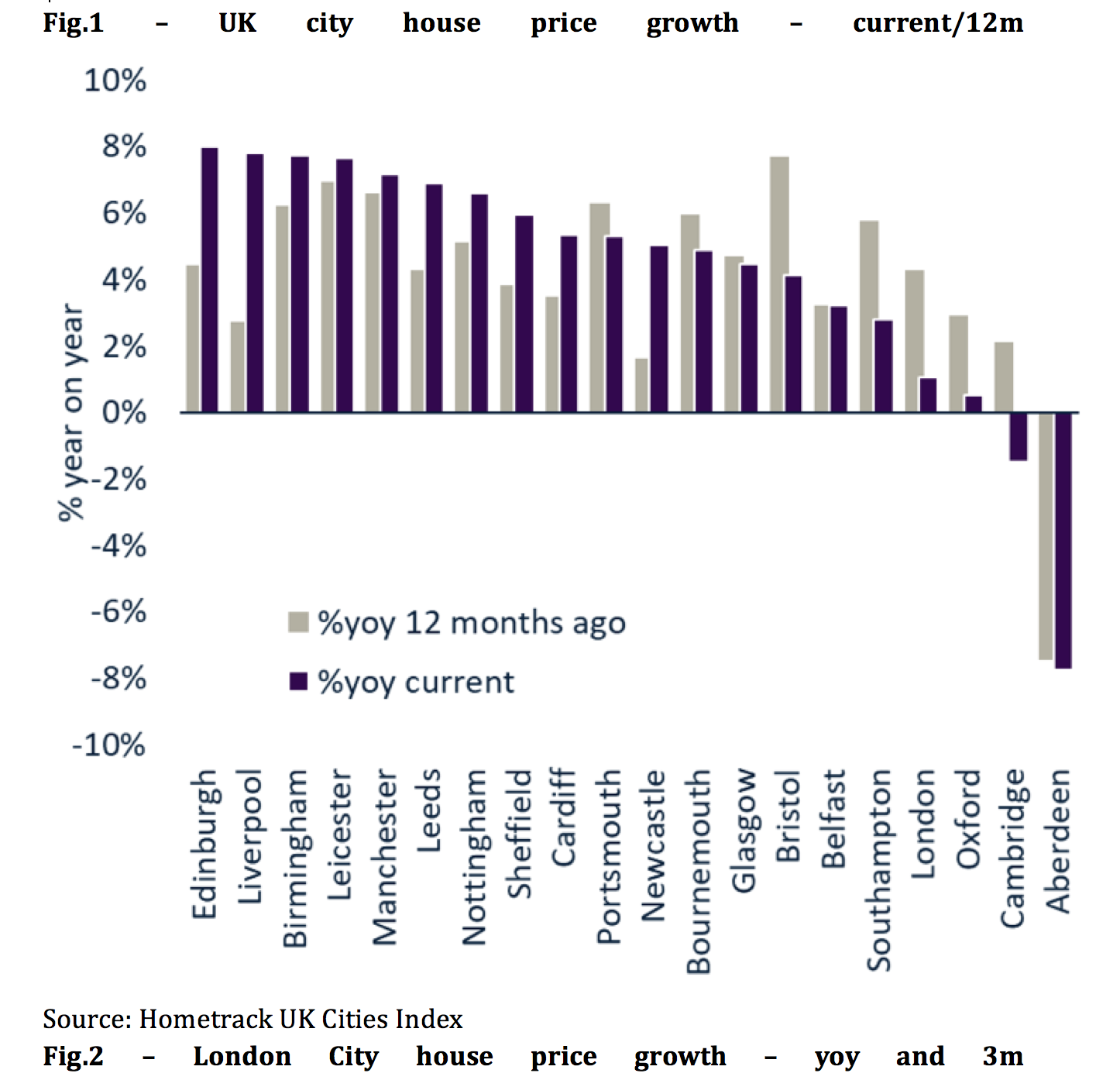

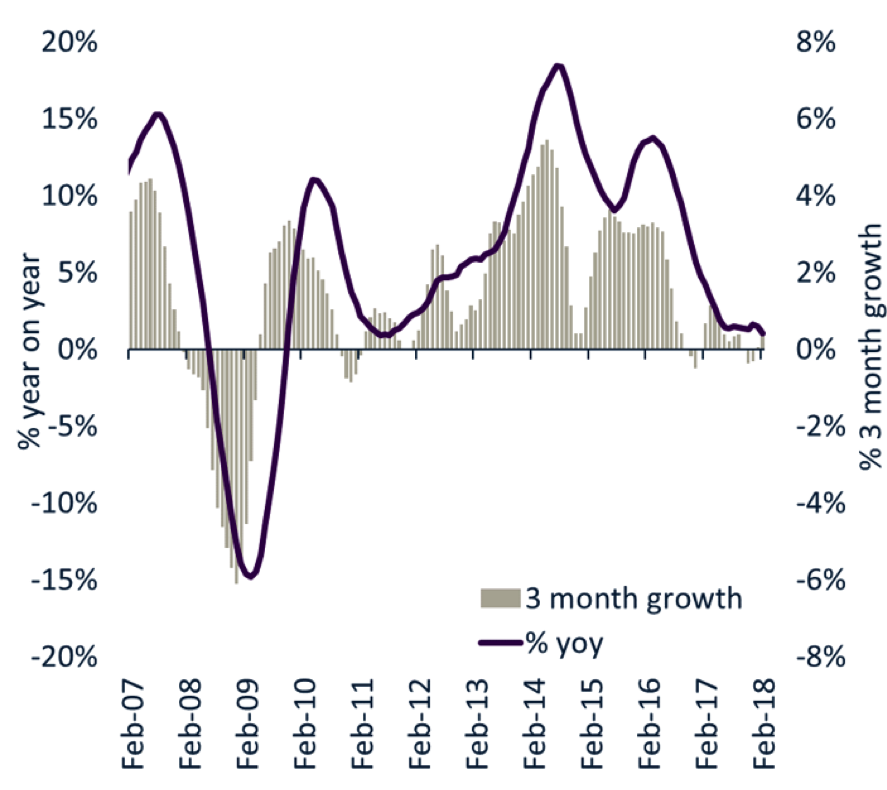

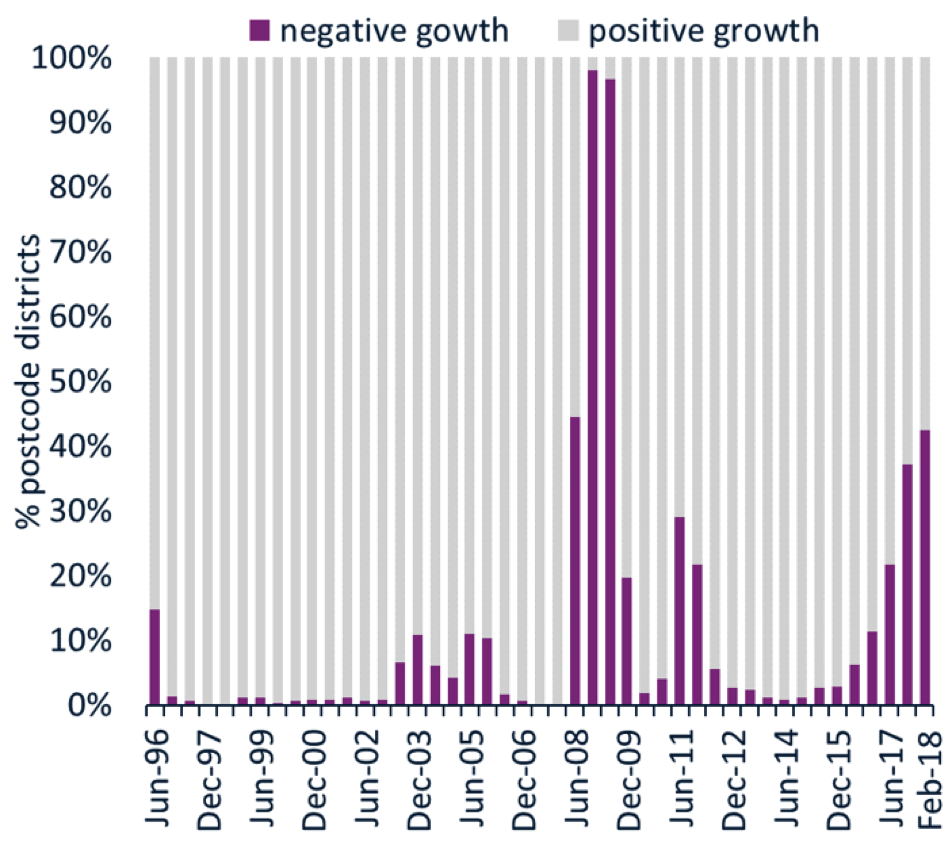

- Real Estate Market

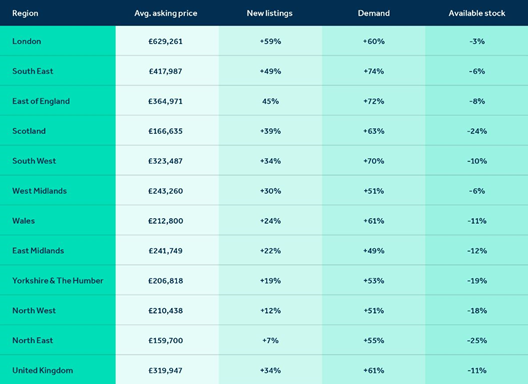

According to Rightmove’s report at the end of August, Harlow is where new sellers have been most tempted to come to market, with the number of new listings up 121% compared to the same time last year.

CBRE 2018 report also shows that house prices in Harlow to rise by 20% by 2023. In its 5-year forecast released in 2018, CBRE predicted 18% rental growth in Harlow between 2019 and 2023, which is similar to London at an average of 3.6% per year.

Strawberry Star estimates that Harlow is a place where the yield of housing property investment can reach up to 5%.

In addition, we can predict Harlow’s future housing market from the population growth figures. The government-led regeneration of Harlow and the establishment of Harlow Enterprise Zone in 2017, will create more clusters of jobs and, along with population growth, boost demand for housing. More than 44% of them are Londoners. Demand for housing is strong, driven by a projected population growth of 22% by 2039 and a shortage of housing supply.

References

Barratt Homes (2020) Gilden Park. Accessible at: https://www.barratthomes.co.uk/new-homes/essex/h685001-gilden-park/

Countryside (2020) Atelier. Accessible at: https://www.countrysideproperties.com/all-developments/essex/atelier?gclid=Cj0KCQjwnqH7BRDdARIsACTSAdtUg9m2-RXorgtEdB6t3ahR24LM_RB3Z3UXovcIlQK9k4sm5jCk65gaAsBAEALw_wcB

Harlow Enterprise Zone. Accessible at: http://harlowez.org.uk/about-harlow-enterprise-zone/

Persimmon LTD (2020) Gilden Park. Accessible at: https://www.persimmonhomes.com/gilden-park-10406

Strawberry Star (2018) Harlow Housing Market Report. Accessible at: https://strawberrystar.co.uk/wp-content/uploads/2020/02/Harlow-Housing-Report-Strawberry-Star.pdf

Strawberry Star (2020) Harlow set to be revitalised as Strawberry Star launch new Harlow Quarter development. Accessible at: https://www.strawberrystar.com/news/press-releases/harlow-set-to-be-revitalised-as-strawberry-star-launch-new-harlow-quarter-development/

Strawberry Star (2020) Harlow Quarter – Essex. Accessible at: https://strawberrystar.co.uk/developments/harlow-quarter-essex/

Taylor Wimpey LTD (2020) Gilden Park. Accessible at: https://www.taylorwimpey.co.uk/find-your-home/england/essex/harlow

Rightmove (2020) Stamp duty holiday sparks home-moving frenzy. Accessible at: https://www.rightmove.co.uk/news/articles/property-news/stamp-duty-holiday-home-moving-frenzy